There is a reason that you have that shiny piece of metal, that you call “your pride and joy,” in your garage. It’s your baby, and you love the magic that classic automobiles represent in American history. There’s nothing better than turning the key and taking your baby for a drive to forget the hectic work week and remind you why you love classic cars so much. Driving your classic vehicle, even for a short ride, without insurance is unwise and in most states, illegal.

If you drive your collector car on public roadways, you need to have insurance by law. In almost every case, collector car insurance makes the most sense.

How do you know what insurance is correct for your classic car? Should you just add it to your existing auto policy to get a multi-vehicle discount? How do you make sure that you are covered correctly and not over, or under, insured? We reached out to one of the largest collector car insurance companies, Hagerty Insurance Agency, and spoke at length with the vice president of public relations, Johnathan Kliger, to find out the do’s and dont’s of collector car insurance.

About Hagerty Insurance

Based in Traverse City, Michigan, Hagerty Insurance Agency specializes in classic car insurance. “We are the largest when it comes to collector car insurance companies,” claimed Kliger. “We enjoy what we are doing. Everything we do here begins and ends with the love of the automobile. If it doesn’t help foster that, then we are not interested. That provides the arching theme of how we approach things.”

We will even insure tanks if they are not in active military use. – Jonathan Klinger, Hagerty Insurance Agency

Participating in everything from scholarship programs for students interested in working in the collector car market to partnering with car museums, Hagerty Insurance has become a keystone in the classic car market. The company stays current with classic car trends by publishing a monthly magazine for car collectors, Hagerty Classic Cars, available online and in print. Hagerty also partnered with Hemmings Motor News to provide pricing information for classic cars.

Collector cars are collectible for a reason. They tend to go up or hold a steady value that is significantly higher than the original purchase price. They need to be covered by insurance that deals with these specialty vehicles.

What Is A Collector Vehicle, And Why Does It Need Special Insurance?

“When we say collector vehicle, that means many things,” explained Kliger. “It’s your traditional classic car that you typically think of but it’s also motorcycles, trucks, firetrucks, military equipment, and even more modern vehicles,” he said, adding, “The simplest way to look at is: a collector car policy is designed for someone’s fun car that they don’t have to have. It’s not their regular used transportation, it’s not the car that use for your primary means to and from work. We will even insure tanks if they are not in active military use.”

Enthusiasts may not have to have a collector car, but many of us do. And when we have one, the owner must take a look at automobile insurance policies, especially if the vehicles gets driven at all. Klinger explained the difference in insurance and collector car insurance, “The biggest fundamental difference between a classic car policy and a standard car policy is how they look at the value of the vehicle.”

Explaining that most collector cars have gone through a depreciation curve, which started as soon as it was driven off the lot for the first time as a new vehicle. “The vehicle price immediately starts to go down in value for a given length of time, hits the bottom of that curve, then starts going up in value again as people start seeking those vehicles for collector vehicles. At some point they are going to appreciate past the point of their original purchase price, even when adjusted for inflation, and that’s when they truly are a collector vehicle,” Klinger rationalized.

Vehicles start to depreciate as soon as they are driven off the dealer’s lot. At some point, the market value goes up as people start seeking those vehicles for collector vehicles. This is when they really reach collector car status.

Identifying what is a collector vehicle using value is critical in understanding why there are different types of insurance policies. “You have to look at the value of collector vehicles differently than you do those with a regular auto policy. A typical auto policy is designed for vehicles that are depreciating in value,” he clarified.

“With a typical auto insurance policy, the car starts to devalue as soon as it leaves the lot, and if something happens to it, the insurance company will place a value on the car based on what they think is the fair market value at the time of the loss,” added Klinger. “That is based on several factors. A collector car that is holding it’s value and not going anywhere, you look at that much differently.”

What Type Of Policy Is Needed For Collector Cars?

If you have a collector car that was $3,000 when purchased new, and now it is highly desirable and worth $50,000 on the market, it would be nice to get the real value of the car if it is totaled for some reason. Classic car insurance should cover any repairs, or replace your pride and joy as if it was the collector car that it is, and not as part of the cash for clunkers program.

“We write what is called a guaranteed value policy,” Klinger said. When a policy is issued for a $30,000 vehicle, that policy is written for a guaranteed coverage of $30,000 in the event that vehicle is totaled. There is no debate about what the car is worth or what similar vehicles are selling for, or anything like that. It removes the burden of proof from the owner trying to prove the real value of the vehicle.”

What this means in the most basic of terms is, a collector car owner needs a policy that promises to cover the agreed valued of a car if the unthinkable happens.

Stay Covered By Knowing Your Car’s Value

Companies like Hagerty pride themselves in treating its customers well. The company stays on top of car values and report car prices in their publications. The agents also do their best to make sure that car owners with policies are well-informed of the value of their vehicles so that they stay properly covered.

In the unfortunately event that your car is involved in an accident, you need to be covered properly. Photo from bc.ctvnews.ca

Klinger explains, “We monitor car values very closely, and if we notice that one of our policy holders are under-insured, we definitely have that conversation with them. We explain that its time to look at the value of their vehicle and they might be underinsured. This can happen occasionally when you have a policy that is staying with the market for several years but then the market changes for whatever reason.”

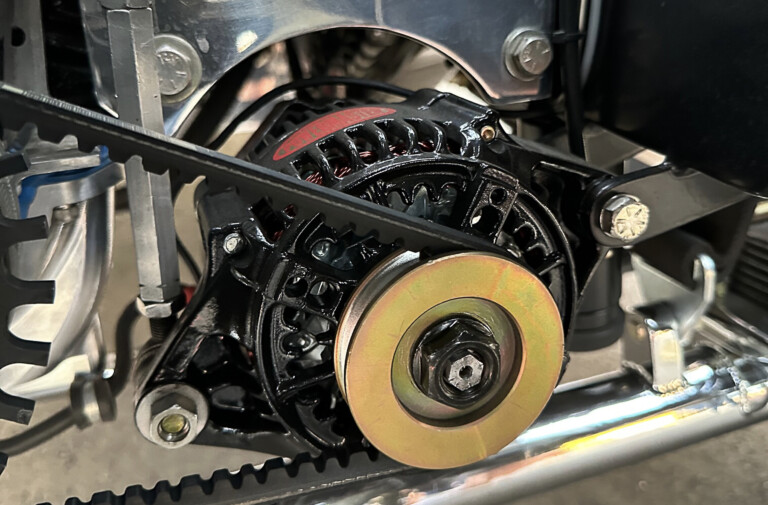

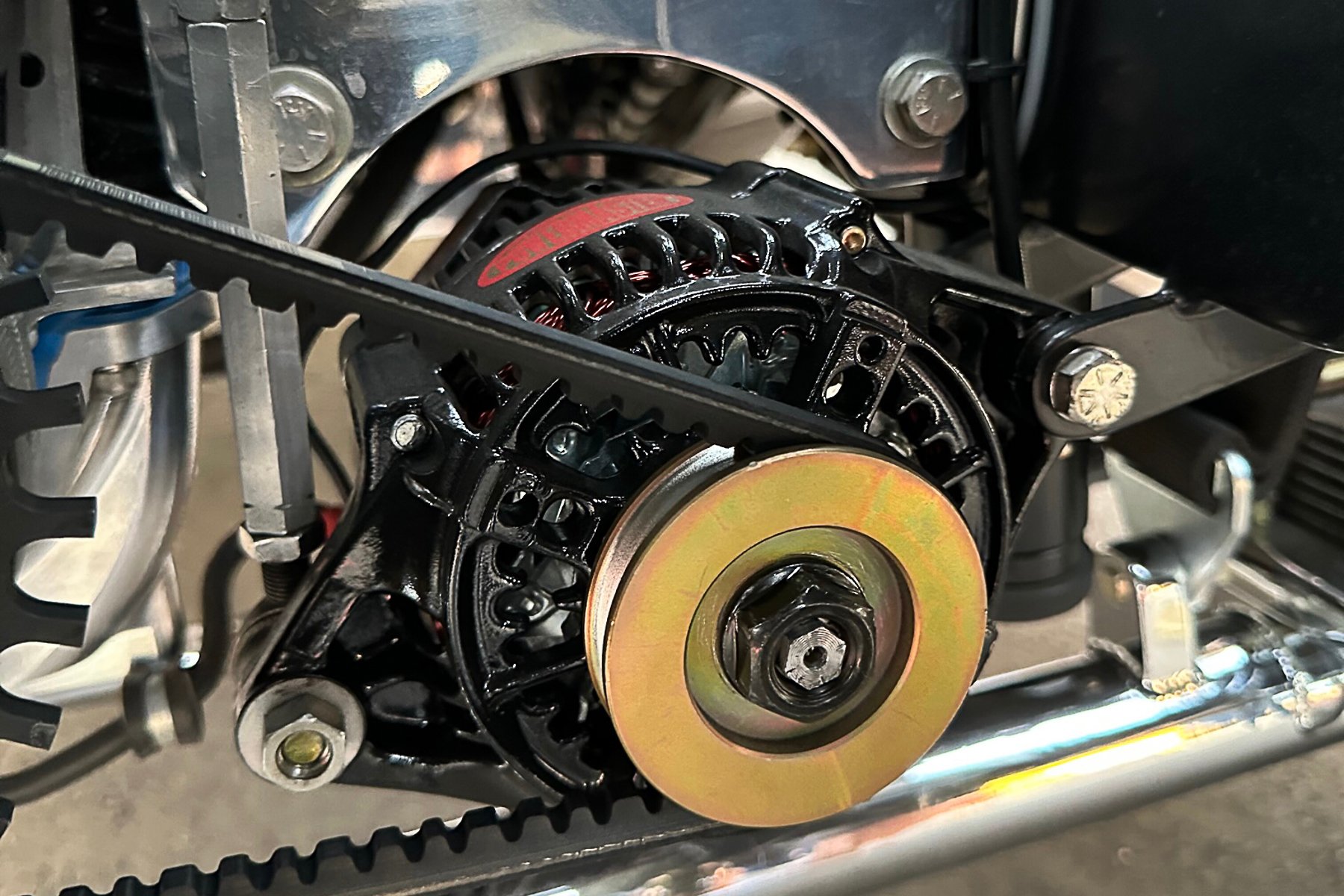

Knowing that the value of a collector car changes all the time, Klinger recommends that collector car owners stay apprised of their car values at all times. “For modified vehicles like hot rods, where it is common for people to spend significant amounts of money on their project, this will allow the owner to insure the car for what the financial investment is,” he said. “If you have a standard vehicle policy, the burden of proof really lies on the owner to fight for what the vehicle is worth or the investment at the time of the loss.”

What Are The Limitations And The Cost?

It may seem untrue but collector car insurance generally costs less than a standard car policy, yet offers higher coverage. It doesn’t take a rocket scientist to figure out that collector car owners are not going to drive their pride and joy like a maniac. This means they are less likely to have an accident in the first place.

“People have their daily driver cars, and they can have an attachment to them, but its not the same as a collector car,” Klinger added. “Most of the time, the collector car insurance is cheaper than a standard policy. There are exceptions to that rule but the majority of the time, collector car insurance is cheaper.”

Collector car owners are not going to drive this car like a 1972 Blazer. Knowing this, the car insurance companies price their coverage accordingly.

The limitations are very different than the restrictions for registering your collector car as an antique or street rod. Most states require the cars that are registered as collector cars to be limited to driving to and from an event or for maintenance.

If its good for the hobby, its good for all of us. – Jonathan Klinger, Hagerty Insurance Agency

There are not as many restrictions as many people would assume that there are. “We don’t say how or when you can use your vehicle because we only insure people that love cars. They are not going to knowingly put the car in danger. They are not going to let the car sit in the shopping mall parking lot unattended for four hours or something like that. Those are things we don’t have to police.”

These newer types of insurance policies are different than the traditional collector car insurance policies that were once very strict and limited how the covered vehicles could be used. In addition to the old mindset of travel restrictions, many collector car owners were trained to call their insurance agents when they stored their cars for the winter.

“Some owners that live in certain areas of the country were in the mindset that you take the cover off of the car in the spring, and when you put it back on in the fall, you have to call your agent and let them know that you aren’t going to drive your car for a couple of months,” Klinger explained. “We know that. We know that the car is going to be stored in the winter-time and you don’t have to go through that hassle. It’s just covered year round and the policy is priced for that.”

Who Handles The Claims?

“One thing that your readers should know when buying collector car insurance is who handles the claims for the company,” he advised. “If something happens, does the company have an in-house person that handles the claims, or is it farmed out to a third party claims center who handles any given number of claims? That is an important distinction.”

According to Klinger, a general claims person isn’t going to understand that some collector cars have windshields that may cost $25,000. Trying getting someone who is used to $200-$500 windshields to understand the difference is difficult. “Or, the fact that particular body panels have to be made from scratch because replacement parts just don’t exist in the aftermarket anymore, and can add to the cost of replacement of these items in a collector car.”

For a car that is heavily customized, the car owner should be able to pick who does the repair work after an accident. Often the builder that did the original work is the only person that can return a car back to pre-wreck condition.

One final thought that Klinger wanted to mention for collector car owners looking for insurance deals with repair shops. “We allow our customers to choose their own repair shop, or if they do their own work, we’ll pay them for the claim. There is no forced, inside network that you have to choose from,” he stated. “On the other hand, if people are looking for assistance for some shops to repair damage, we have a network of companies that we can steer them to.”

The Final Word

It’s clear that collector car insurance is different today than it was in the past, and modern companies like Hagerty Insurance have been instrumental in those changes. Making sure that you are adequately covered for the right value of your vehicle, that the claims are settled in-house, and collector car owners can select their own repair shops are major improvements in the insurance industry. “If its good for the hobby, its good for all of us,” added Klinger.